Client Summary

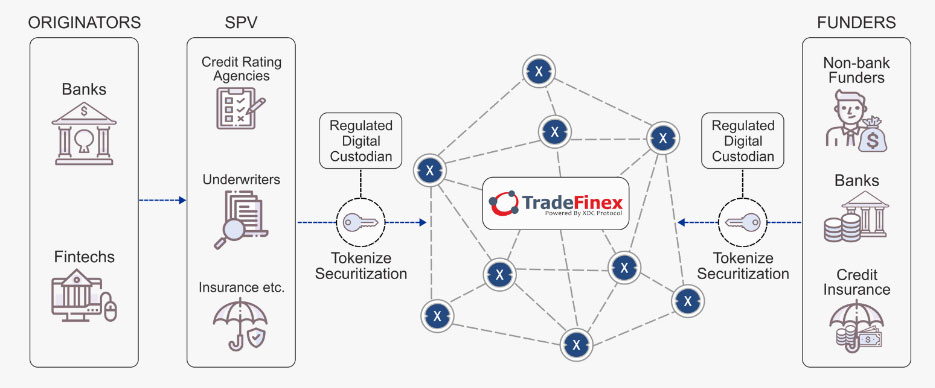

The TradeFinex platform was launched with the intent to digitize the traditional finance ecosystem and bring more efficiency, accuracy, and transparency into the full spectrum of deals and transactions in this ecosystem.

Powered by the XDC Protocol, a wide range of organizations leverage the platform to view investment opportunities available on the XDC Network and other networks on the blockchain.

DEX Aggregator Functionality

The platform offers a DEX aggregator functionality that enables traders and investors to easily access various trading pools using a single dashboard.

Informed Decision Making

TradeFinex enables easy comparisons of various pools and the opportunity to make informed investment decisions.

Wide Range Of Tools

The platform also offers a range of tools and resources to help manage and maximize return on investments.

Investment Opportunities

Both seasoned and newer investors can leverage TradeFinex to navigate investment opportunities on-chain and benefit from its many advantages.

Core Business Challenge

TradeFinex aims to address a spectrum of problems prevalent in the traditional financial system. Here's a snapshot of looming issues:

Accessing loans backed by real-world assets is a time-consuming and cumbersome process. It's also expensive due to the involvement of intermediaries like banks, origination platforms, and bureaucratic legal procedures. While some of the processes are necessary to assess the value of the collateral and verify ownership, they can sometimes inflate and become rent-seeking mechanisms. This approach prolongs and complicates the lending process.

Another core challenge is the lack of access to liquidity in the DeFi market. DeFi protocols and applications are relatively new and not as widely adopted as traditional financial systems. Hence, it's difficult for users to take advantage of DeFi services and access the liquidity they need to make transactions. TradeFinex aims to facilitate the easy discoverability of these liquidity pools offered by the DeFi market, thus unlocking a pool of capital that can be used for lending and other financial transactions.

Finite liquidity in Web 2 (primarily operating on fiat currency) is unable to meet the growing market demands.

The network generates a multitude of investment opportunities. However, the Blockchain Network Community lacks awareness of these opportunities at large. The TradeFinex platform aims to onboard and promote awareness of the on-chain liquidity of these opportunities to the community.

Trade finance-based investors have access to a wide range of investment options, including collateral-backed loans, gold-backed tokens, and pools of assets from the Web 2 world. Similar opportunities that enable investors to diversify their portfolios and potentially generate higher returns on their investments with pools that allow Senior and Junior tranche investment options need to be made available on Web 3.

Our Solution

Trade finance and DeFi are two very different fields with great potential to converge in a mutually beneficial manner. Traditional trade finance relies on rolling dates, making it difficult to secure static financing. With the advent of DeFi, continuous revolving pools have become available, with the potential to make financing between buyers and suppliers much easier. These revolving pools allow asset originators to originate loans continuously. As investors extend credit lines to the asset originator, the asset originator can repay these loans and mint more trade finance invoices. This triggers a continuous cycle of financing that can make it much easier for buyers and suppliers to secure the funding they need to conduct trade.

Here's a snapshot of the TradeFinex platform's seamless workflow after Yodaplus Technologies' intervention:

Asset originators can easily fill out an onboarding form to get their assets listed on TradeFinex's platform. The form requires basic information and technical details, such as the link to the investment portal where investors can buy and sell, the deployment address of the pools or investment tokens, and API endpoints for sharing data from Web 3 and Web 2 sources, including the current supply of investment tokens, the NAV at which investors can buy and sell, the APY of senior and junior tranches, and a list of assets where investors' money is being invested.

Access to such detailed information allows investors to have complete transparency into the activity of liquidity and lending pools.

Once the asset is onboarded on the platform, it goes through a computer check to verify the accuracy of the data provided by the Asset Originator. If the data is correct and the pool meets the necessary criteria, it's whitelisted and displayed on the platform. Potential investors can now review and consider the asset for investment.

The whitelisting process ensures that only high-quality assets are displayed on the platform, thus helping maintain the integrity and reputation of the platform.

Solution Outcomes

The TradeFinex platform is now equipped with the technology to bridge the gap between real-world assets and the DeFi ecosystem.

- 1

This is a valuable platform to discover and make more informed decisions to invest in pools and tokens after comparing all available investment options.

- 2

There are no more limitations due to geographical and investment medium barriers.

- 3

In the current scenario, many companies and individuals are excluded from traditional financing sources due to their size, location, or circumstances. With the platform's new capabilities, asset originators have significantly improved access to competitive financing. This opens up new opportunities for asset originators to secure financing and accelerate the growth of their businesses.

Other Case Studies

July 1, 2024 Yodaplus

Ensuring Shariah Compliance and Transparency in Digital Gold with Comtech Gold

May 31, 2024 Yodaplus

Revolutionizing Data Reporting with GenRPT

April 30, 2024 Yodaplus

Transforming Credit Limit Management: A Strategic Framework for Sustainable Project Financing in Latin America and the Caribbean

July 18, 2023 Yodaplus