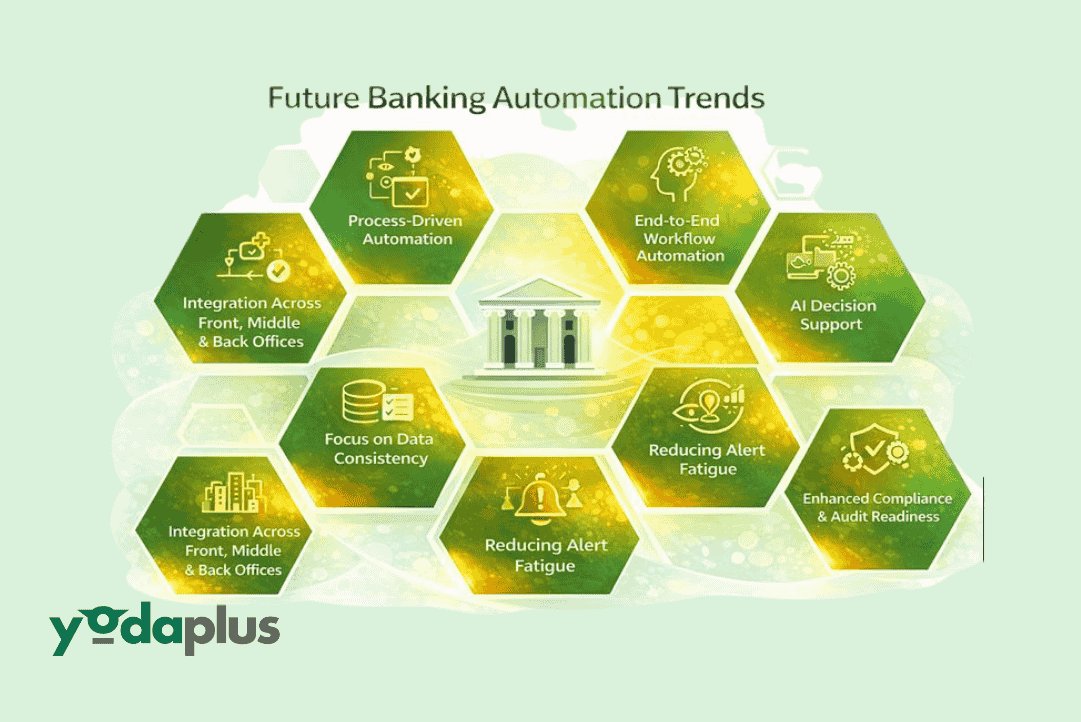

Future Banking Automation Trends to Watch

January 28, 2026 By Yodaplus

Banking automation is entering a new phase. Early automation focused on task replacement. Today, banks are rethinking how entire financial processes operate. This shift is driven by rising data volumes, tighter regulations, and growing pressure on decision speed.

Finance automation is no longer about saving time alone. It is about reducing risk, improving consistency, and supporting better decisions across banking operations. As AI in banking matures, expectations are changing. Banks now want automation that fits into real workflows rather than isolated tools.

This blog explores future banking automation trends and explains how financial process automation is evolving across operations, compliance, and research functions.

Automation moving beyond task replacement

Early banking automation focused on repetitive tasks. Data entry, reconciliation, and report generation were automated to reduce manual effort.

Future banking automation is shifting toward process ownership. Instead of automating single steps, banks are automating end to end workflows. This includes approvals, validations, escalations, and reporting.

Banking process automation now aims to ensure that work flows consistently across systems and teams. Workflow automation becomes the backbone that connects tasks into reliable processes.

This shift improves transparency and reduces operational risk.

Finance automation becoming process centric

Finance automation is moving away from tool driven adoption toward process centric design. Banks are mapping how financial work moves across departments before selecting automation solutions.

This approach improves outcomes because automation aligns with real business behavior. Financial services automation works best when processes are clearly defined and owned.

Future trends show banks investing more time in process clarity. Automation then enforces consistency rather than creating complexity.

Financial process automation becomes a governance tool rather than a productivity shortcut.

AI in banking becoming decision support

AI in banking is evolving in its role. Early adoption focused on prediction and detection. Models flagged risks, trends, or anomalies.

The future focuses on decision support. Artificial intelligence in banking highlights signals, but decisions remain embedded within workflows.

This reduces false confidence in AI outputs. Banking AI supports reviewers by prioritizing issues and providing context.

AI in banking and finance becomes more explainable and accountable when paired with workflow automation.

Intelligent document processing as a foundation

Documents remain central to banking operations. Financial reports, contracts, approvals, and research documents drive decisions.

Future banking automation relies heavily on intelligent document processing. This technology converts documents into structured and validated data.

Without intelligent document processing, finance automation operates with blind spots. AI models and workflows rely on incomplete information.

Banks increasingly treat document intelligence as a core layer of financial services automation rather than an add on.

Workflow automation across front, middle, and back office

Banking automation is expanding across organizational boundaries. Workflow automation now connects front office actions with middle and back office controls.

This improves coordination and reduces handoff delays. Financial process automation ensures that approvals, validations, and postings follow defined paths.

Future trends show tighter integration between operational workflows and risk controls. Automation in financial services becomes more holistic.

This shift improves audit readiness and operational resilience.

Reducing alert fatigue through smarter automation

One of the biggest challenges in banking automation is alert fatigue. AI systems generate signals faster than teams can review them.

Future banking automation focuses on reducing noise. This includes combining rules with AI and embedding alerts into workflows with clear ownership.

Finance automation systems increasingly route alerts directly to responsible roles. This reduces confusion and speeds up resolution.

Smarter workflow automation ensures that alerts lead to action rather than accumulation.

Automation supporting compliance and audit readiness

Compliance remains a key driver of banking automation. Regulatory expectations continue to increase.

Future financial process automation embeds compliance checks directly into workflows. This ensures controls operate continuously rather than during audits.

Intelligent document processing supports audit readiness by ensuring documents are complete and traceable.

Automation in financial services reduces compliance risk by making controls part of daily operations rather than periodic reviews.

Impact on equity research and investment research

Automation trends also affect equity research and investment research. Research teams face growing coverage demands and tighter timelines.

AI in investment banking helps scan financial data and equity reports at scale. However, workflow automation ensures that research processes remain consistent.

Future trends show more automation around version control, review cycles, and data freshness.

Financial services automation supports analysts by reducing administrative burden while preserving judgment.

Data consistency becoming a priority

Future banking automation places strong emphasis on data consistency. Fragmented systems create risk and inefficiency.

Finance automation increasingly focuses on ensuring that data flows consistently across processes. Workflow automation tracks changes and dependencies.

This reduces reconciliation issues and improves confidence in reporting.

Artificial intelligence in banking performs better when data quality is reliable.

Human oversight remaining essential

Despite advances, human oversight remains critical. Banking automation does not remove accountability.

Future trends emphasize clear ownership. Automation handles execution. AI highlights signals. Humans make decisions.

This balance improves trust in automation and reduces operational risk.

Financial process automation works best when teams understand where automation ends and judgment begins.

Integration over replacement

Banks are moving away from replacing systems. Instead, they integrate automation into existing environments.

Workflow automation acts as a coordination layer across tools. Intelligent document processing connects unstructured data. AI adds analysis.

This integration driven approach reduces disruption and accelerates adoption.

Automation in financial services becomes more sustainable and scalable.

Measuring automation success differently

Future banking automation trends include new success metrics. Time savings alone are no longer sufficient.

Banks measure reduction in rework, improved compliance outcomes, and decision consistency.

Finance automation success is increasingly tied to risk reduction and operational stability.

This shift changes how automation programs are designed and evaluated.

Preparing for scalable automation

Scalability is a key concern. As volumes grow, manual controls fail.

Future financial process automation focuses on scalability by design. Processes are standardized. Exceptions are clearly handled.

AI in banking supports scale, but workflows ensure control.

This prepares banks for growth without increasing operational risk.

Conclusion

Future banking automation trends show a clear shift toward structured, accountable, and integrated automation. Finance automation is moving beyond task replacement toward end to end process control.

AI in banking adds value when it supports decisions rather than replacing them. Intelligent document processing ensures reliable inputs. Workflow automation provides structure and accountability.

Financial services automation succeeds when technology aligns with real processes and human ownership.

At Yodaplus, Financial Workflow Automation focuses on building finance automation systems that scale with clarity, reduce risk, and support confident decision making across banking operations and research workflows.