Equity Research vs Investment Research: What’s the Difference?

July 25, 2025 By Yodaplus

In finance, information is everything. Investors rely on data-backed insights to decide where to place their money. But not all research is created equal. Two terms often used interchangeably, equity research and investment research may sound similar, but they serve different roles in the investment process.

This blog breaks down the difference between the two and explains how they work together to guide decision-making for financial advisors, asset managers, and portfolio managers.

What Is Equity Research?

Equity research focuses specifically on companies listed on public stock exchanges. It aims to evaluate a company’s performance, understand its competitive position, and offer an investment rating such as “buy,” “hold,” or “sell.”

Equity research analysts spend time analyzing balance sheets, quarterly earnings, market trends, and macroeconomic outlook to recommend whether investors should take a position in a stock. These reports are critical for wealth advisors and financial consultants who want detailed insights into specific securities.

What Is Investment Research?

Investment research has a broader scope. It includes not only individual stocks but also bonds, commodities, real estate, mutual funds, and alternative assets. The goal is to evaluate an overall investment opportunity rather than a single stock.

For example, an investment analyst might compare the long-term return potential of emerging market ETFs with that of US Treasury bonds. Their report may cover topics like interest rate impact, geopolitical risk, or inflation expectations.

Investment research also plays a major role in portfolio risk assessment and asset allocation strategies, helping portfolio managers strike the right balance between return and risk.

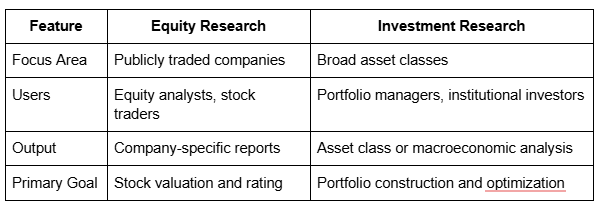

Key Differences

In short, equity research zooms in, while investment research zooms out.

How Technology Is Bridging the Gap

In the past, research involved manual data entry, Excel modeling, and time-consuming formatting. Now, AI-powered tools like AI report generators and AI for data analysis are making things faster and more accurate.

Equity research automation enables analysts to process financial data quickly, spot trends, and generate models with fewer errors. This means analysts spend more time on insights and less time on repetitive work.

On the other hand, AI for investment research helps identify signals across various asset classes, model different risk scenarios, and recommend strategies that fit client goals. Tools built for financial data analysts are now able to process large datasets, from historical market data to news sentiment and convert them into actionable portfolio insights.

When Should You Use Which?

If you want to know whether to buy a specific stock, equity research is your best source. But if you’re building a diversified portfolio or reviewing market risk analysis, investment research is the way to go.

In most firms, the two work together. Investment research guides the overall strategy, while equity research supports individual stock decisions that align with that strategy.

Final Thoughts

Understanding the difference between equity research and investment research helps clarify their value in shaping financial decisions. Whether you’re a financial advisor working with clients or a portfolio manager designing a long-term strategy, knowing when and how to use each type of research can improve your performance and client outcomes.

As the finance world becomes more data-driven, technology will continue to enhance both research types. Platforms that integrate AI for equity research and portfolio modeling tools are already making this shift. Analysts who adopt these technologies early are likely to gain a competitive edge.

GenRPT Finance by Yodaplus is designed to support this transformation. It automates the generation of equity research reports, pulls data from multiple sources, and simplifies complex analysis, giving your team faster, smarter insights with less manual work.