Using Anomaly Detection to Reduce Financial Risk

January 28, 2026 By Yodaplus

Financial risk is not always driven by major failures. In many cases, it builds quietly through small irregularities that go unnoticed. Missed approvals, unusual transactions, delayed reconciliations, or inconsistent data can all increase exposure over time.

As finance automation becomes more common, anomaly detection plays a central role in identifying these issues early. AI in banking is often promoted as the solution, but real risk reduction depends on how anomaly detection is applied inside financial process automation.

This blog explains how anomaly detection helps reduce financial risk, where its limits lie, and why banking automation must focus on both technology and workflow design.

What anomaly detection means in finance automation

Anomaly detection in finance refers to identifying behavior or data that does not match expected patterns. This can involve transactions, processes, or documents.

In banking and finance, anomalies may appear as unexpected transaction values, delays in approvals, repeated corrections, or inconsistencies in financial reports. These signals often indicate operational risk, compliance gaps, or reporting issues.

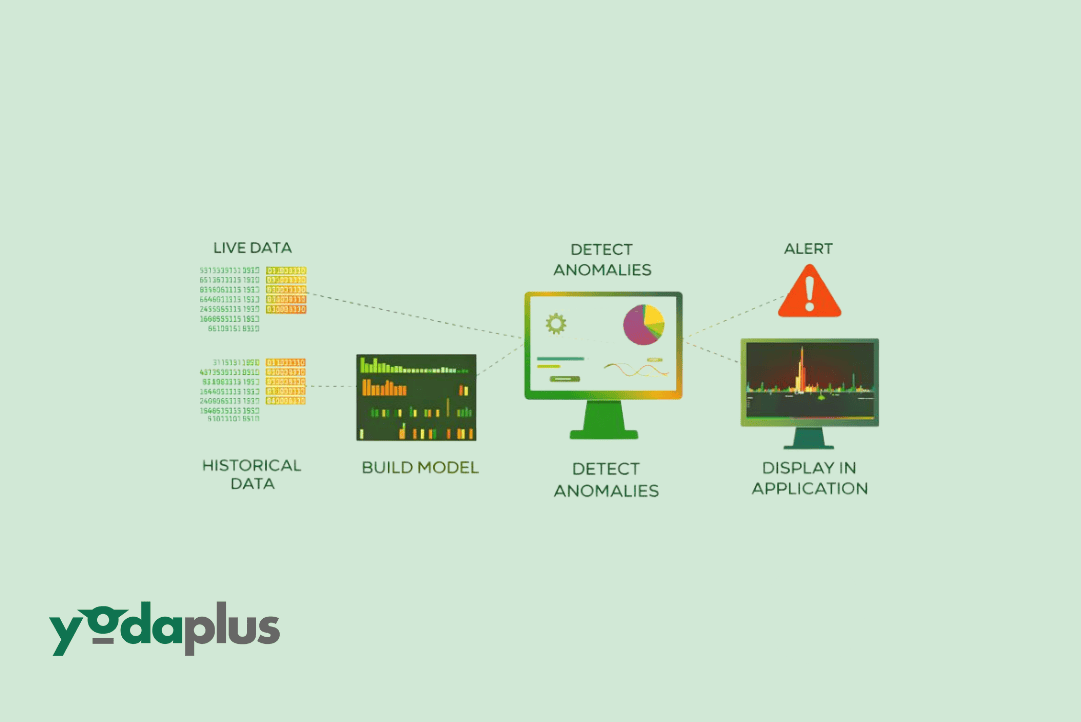

Finance automation systems use rules, statistical models, and AI in banking and finance to surface these signals at scale. When designed correctly, this reduces reliance on manual checks and improves consistency.

Why anomaly detection matters for financial risk

Financial risk often emerges before losses occur. Anomaly detection helps teams identify early warning signs.

In banking automation, this includes detecting unusual transaction behavior, monitoring deviations in workflows, and identifying data quality issues before they affect reporting.

Artificial intelligence in banking improves coverage by scanning large datasets continuously. This allows teams to respond faster and reduce exposure across financial services automation environments.

Without anomaly detection, many risks remain invisible until audits, customer complaints, or regulatory reviews uncover them.

Transaction anomalies and risk exposure

Transaction anomalies focus on individual financial events. These include unexpected payment amounts, irregular timing, or unusual counterparties.

Banking process automation frequently starts here because transaction data is structured and accessible. AI banking tools compare current transactions against historical norms to flag outliers.

This approach reduces immediate risk related to fraud, errors, and unauthorized activity. However, transaction anomalies alone do not capture the full picture of financial risk.

Process anomalies and hidden risk

Process anomalies emerge across workflows rather than individual events. These include delayed approvals, skipped validation steps, repeated rework, or inconsistent postings.

Financial process automation depends on workflows moving smoothly across systems and teams. When these flows break, risk accumulates quietly.

AI in banking may validate a transaction while missing that the approval occurred late or the supporting document was incomplete. These gaps often surface during audits or regulatory reviews.

Reducing financial risk requires visibility into process behavior, not just transaction behavior.

The role of intelligent document processing

Documents are a major source of financial risk. Financial reports, equity research reports, invoices, confirmations, and audit evidence often exist outside core systems.

Intelligent document processing converts documents into structured and validated data. This enables finance automation systems to track completeness, accuracy, and timing.

Without intelligent document processing, anomaly detection relies on partial signals. With it, workflow automation gains end to end visibility and improves risk detection.

This is especially important in financial services automation environments where compliance depends on document accuracy.

Impact on equity research and investment research

In equity research and investment research, financial risk is linked to decision quality. Inconsistent data, outdated assumptions, or missing updates can affect an equity research report.

AI in investment banking can highlight numerical changes across reports, but it cannot always detect process anomalies such as missed reviews or incomplete documentation.

Workflow automation and document intelligence help reduce these risks by ensuring research processes follow defined steps. Anomaly detection then supports analysts instead of replacing judgment.

This improves trust in research outputs while maintaining efficiency.

Combining anomaly detection with workflow automation

Anomaly detection reduces financial risk when embedded inside workflow automation. Rules define expected behavior. AI highlights deviations. Humans review and resolve exceptions.

Banking automation systems that rely only on anomaly scores create alert fatigue and confusion. Financial services automation works best when ownership and escalation paths are clear.

Finance automation should treat anomaly detection as decision support rather than final authority.

What realistic risk reduction looks like

Effective financial process automation starts with process clarity. Teams define workflows, controls, and responsibilities before applying AI in banking.

Transaction anomalies and process anomalies are monitored together. Intelligent document processing ensures clean inputs. AI models surface risks early while humans maintain accountability.

This balanced approach reduces financial risk without introducing new operational complexity.

Conclusion

Anomaly detection is a powerful tool for reducing financial risk, but only when used correctly. AI in banking adds speed and scale, not certainty.

Transaction anomalies reveal immediate issues. Process anomalies expose deeper weaknesses. Financial services automation must address both to be effective.

At Yodaplus, Financial Workflow Automation focuses on building structured finance automation systems where anomaly detection strengthens control, visibility, and confidence across banking and research workflows.