Does AI in Banking Overpromise on Pattern Detection?

January 28, 2026 By Yodaplus

AI in banking is often presented as a breakthrough for pattern detection. Vendors promise that banking AI can find risks, fraud, and insights hidden deep inside data. For many banks and financial teams, these promises sound compelling. Large data volumes and limited analyst time create real pressure to automate decisions.

But as adoption grows, a harder question is emerging. Does artificial intelligence in banking actually deliver reliable pattern detection, or does it sometimes overpromise what it can do inside real financial workflows?

This blog takes a practical look at pattern detection within financial process automation and explains where AI helps, where it struggles, and why automation in financial services still needs structure and control.

What pattern detection means in banking

In simple terms, pattern detection means identifying repeated behavior, trends, or irregular signals inside financial data. In banking and finance, this includes unusual transaction activity, shifts in revenue or margin patterns, changes in credit behavior, inconsistencies inside financial reports, and deviations across equity research and investment research data.

These patterns matter because they often signal risk, compliance gaps, or business opportunities. Traditionally, analysts detected patterns through experience and manual review. Today, banking automation tools aim to automate this work at scale.

Why AI is attractive for pattern detection

AI banking tools are attractive because they promise speed and coverage. Artificial intelligence in banking can scan thousands of transactions or documents faster than human teams.

Banks use AI in banking and finance for monitoring transactions in real time, reviewing equity research reports, comparing historical and current performance, flagging anomalies in financial data, and supporting workflow automation across teams.

When combined with finance automation, AI appears to reduce manual effort while increasing visibility. This is why many institutions invest heavily in banking process automation platforms with AI features.

Where AI overpromises in real workflows

The challenge is that pattern detection is not only about spotting differences. It is about understanding context.

AI in banking often struggles with lack of business context. Models can detect statistical differences but may not understand why they exist. A sudden revenue spike may be seasonal, contractual, or strategic. Without context, AI flags noise as risk.

Poor data foundations also limit accuracy. Many banking systems rely on fragmented data. Financial reports, PDFs, emails, and spreadsheets remain scattered across tools. Without intelligent document processing, AI operates on incomplete inputs.

Rule blindness is another issue. AI can miss simple compliance rules. Banking automation still depends on workflow automation and rule based checks to ensure regulatory alignment.

False confidence creates risk. Dashboards often present pattern detection as certainty. In reality, AI outputs probabilities. Teams that treat these outputs as final decisions face operational exposure.

This is where artificial intelligence in banking begins to overpromise if it is not grounded in financial process automation design.

The role of intelligent document processing

One of the biggest gaps in AI banking adoption is document handling. Financial services automation depends heavily on documents such as financial reports, equity research reports, investment research notes, invoices, confirmations, and audit evidence.

Intelligent document processing converts documents into structured, validated data. Without this layer, AI models work on partial signals.

Pattern detection improves when intelligent document processing ensures that numbers, dates, and references are accurate before analysis. This reduces false patterns and improves trust in automation.

Pattern detection in equity research and investment research

In equity research, pattern detection supports analysts by highlighting trends across companies, sectors, and time periods. AI in investment banking can scan large sets of equity reports and surface changes in guidance, margins, or valuation assumptions.

However, AI does not replace analyst judgment. Equity research reports often include qualitative reasoning, management commentary, and assumptions. AI banking tools can flag changes, but interpretation still belongs to humans.

Financial services automation works best when AI supports research teams rather than replacing their review process.

Automation versus intelligence in banking

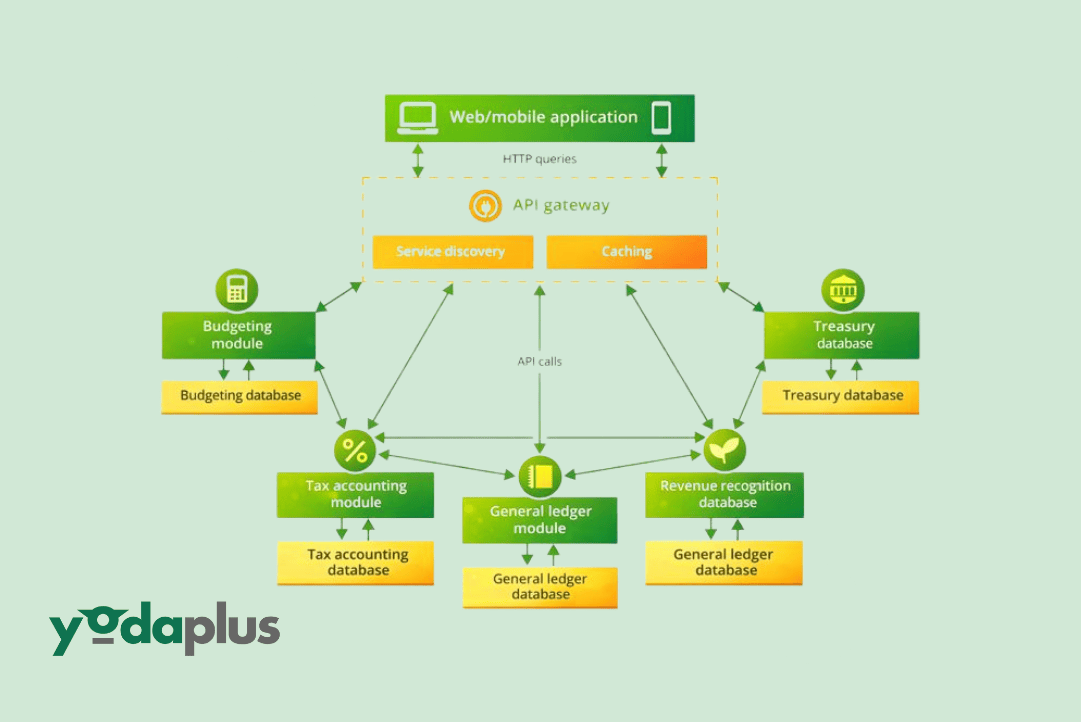

A common misconception is that AI alone delivers automation. In practice, automation in financial services depends on structured workflows.

Workflow automation defines what data enters the system, how it is validated, who reviews exceptions, and how decisions are logged.

AI improves decision quality inside these workflows, but it cannot replace them. Banking process automation without clear ownership creates risk rather than efficiency.

What realistic AI adoption looks like

Banks that succeed with AI in banking follow a balanced approach.

They use finance automation to standardize processes. They apply intelligent document processing before analysis. They combine rules with AI models. They treat AI outputs as decision support. They maintain human oversight for critical steps.

This approach avoids overpromising while still capturing value from banking automation.

Conclusion

AI in banking does not fail at pattern detection, but it often gets oversold. Pattern detection works when supported by clean data, strong workflows, and realistic expectations.

Financial process automation provides the structure. Intelligent document processing provides reliable inputs. AI adds speed and scale, not certainty.

Banks that understand this balance move faster with less risk.

At Yodaplus, Financial Workflow Automation focuses on building structured finance automation systems where AI supports decisions instead of replacing accountability. This helps teams scale banking automation without losing control or trust.