Executive Summary

Our client, the investment division of a notable multilateral development bank, focuses on financing sustainable projects across Latin America and the Caribbean. The evaluation of each project finance proposal is rigorously conducted following pre-established guidelines at various levels including Country, Sector, Sub Sector, Economic Group, Borrower, and Product. These guidelines, crucial for the judicious allocation of scarce capital, are adaptable to shifting economic factors, ensuring that each proposal is evaluated timely and accurately to prevent future delinquencies.

For efficient capital disbursement, it is essential to:

- Obtain a precise overview of the capital previously disbursed to the borrower, alongside its repayment status.

- Identify capital awaiting final approval.

- Review new capital applications.

- Update the borrower's credit rating.

- Perform multi-currency calculations with the latest FX rates.

- Calculate Economic Capital, a risk measure, utilizing contemporary techniques like Marginal VAR and Economic Shortfall for each proposal, whether approved or pending approval.

Core Business Challenge

The client relies on Microsoft Power BI to enforce the above checks and balances. However, this approach has several limitations:

Key challenges included:

-

Data retrieval from the Data Warehouse is manual, bypassing real-time information from source systems. Consequently, the warehouse only contains records of approved capital, leading to outdated data and inaccurate results.

Data retrieval from the Data Warehouse is manual, bypassing real-time information from source systems. Consequently, the warehouse only contains records of approved capital, leading to outdated data and inaccurate results.

-

Power BI's limitations include:

Power BI's limitations include:

- Inflexibility in modifying or setting up temporary limit rules to address breaches.

- Lack of capability for calculating Risk Capital, which must be performed externally with substantial manual effort.

- Absence of transaction history and inadequate User Governance features for role-based access control.

- Failure to reconcile data from various sources, leaving users uninformed about data discrepancies.

- Inability to establish and test what if scenarios defined by users.

Our Solution

The Yodaplus solution effectively addresses these challenges by offering:

-

Easy configuration of limit guidelines and the definition of user governance.

Easy configuration of limit guidelines and the definition of user governance.

-

Document upload capability for limit reviews, directly integrated with the client's SharePoint portal.

Document upload capability for limit reviews, directly integrated with the client's SharePoint portal.

-

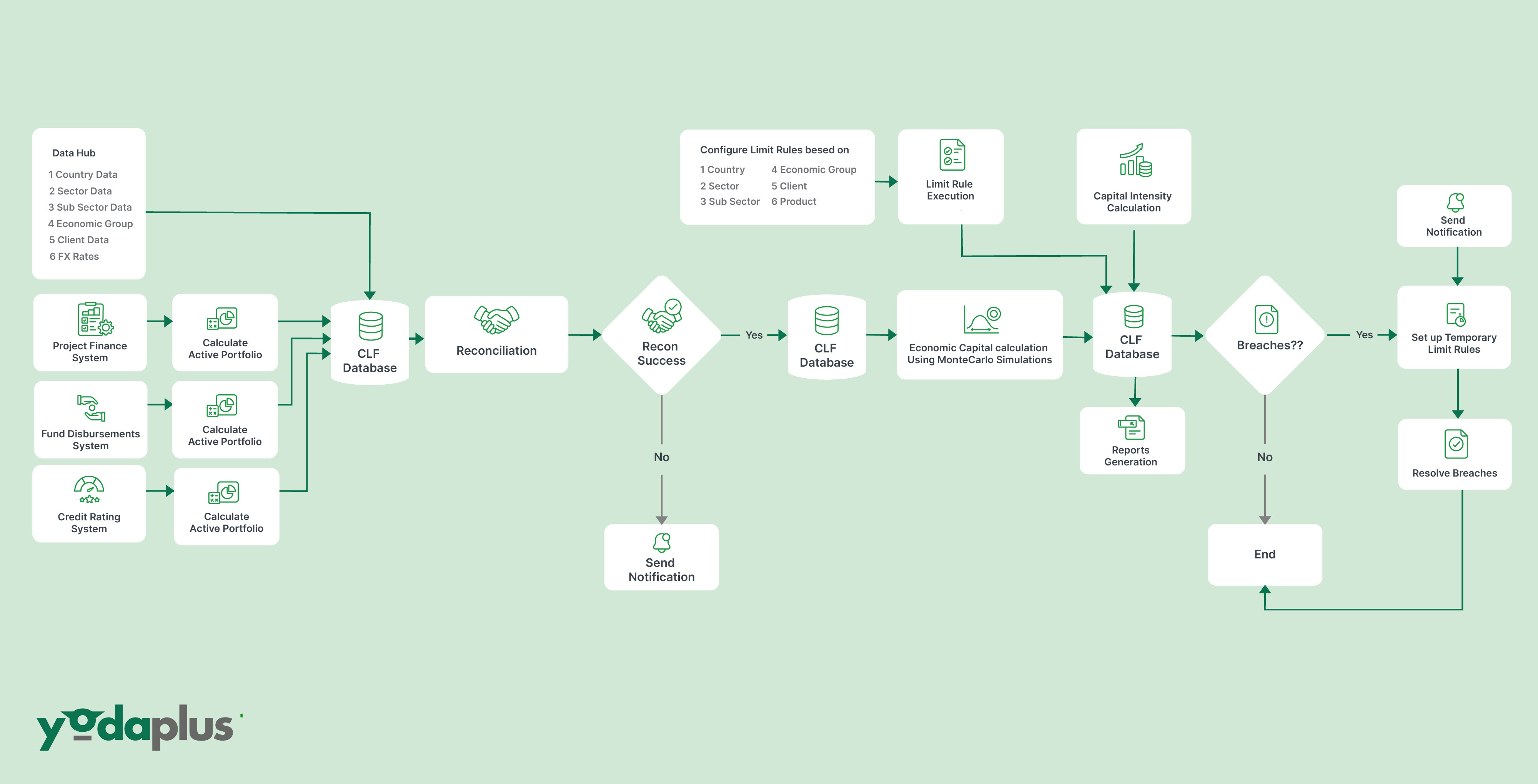

Elimination of manual intervention from data capture to limit rule execution.

Elimination of manual intervention from data capture to limit rule execution.

-

Real-time interfacing with source systems to gather comprehensive information at predefined intervals.

Real-time interfacing with source systems to gather comprehensive information at predefined intervals.

-

Automated reconciliation of source system data, with notifications for data gaps.

Automated reconciliation of source system data, with notifications for data gaps.

-

Accurate Economic Capital calculation using multiple methodologies.

Accurate Economic Capital calculation using multiple methodologies.

-

Real-time execution and reporting of limit checks, with the ability to perform multiple checks daily.

Real-time execution and reporting of limit checks, with the ability to perform multiple checks daily.

-

Maintenance of a comprehensive transaction and check history for audit purposes.

Maintenance of a comprehensive transaction and check history for audit purposes.

-

A user-friendly interface for managing limit breaches through the establishment of temporary limits.

A user-friendly interface for managing limit breaches through the establishment of temporary limits.

Solution Outcomes

-

The implementation of a superior technology stack has significantly improved processing speed, resilience, security, and operational scalability.

-

Real-time data capture has facilitated more efficient, accurate decision-making processes.

-

The platform's design supports continuous innovation, bolstering confidence in its future development. Customized solutions have effectively addressed the redundancy issues commonly encountered with off-the-shelf products.

Starting a Project ?

Get In Touch

Send us your requirements, and get connected with one of our solution experts.

Contact Us