Market Risk vs Portfolio Risk: A Simple Comparison in Investment Research

August 11, 2025 By Yodaplus

In investment research, understanding different types of risk is essential for making informed financial decisions. Two of the most important concepts are market risk and portfolio risk. Both influence how investments perform, but they affect decision-making in different ways.

For financial advisors, asset managers, portfolio managers, and wealth advisors, knowing the difference helps in creating strategies that protect investments while aiming for growth. This guide explains what each type of risk means, how they are measured, and why they are both critical in the context of equity research and portfolio insights.

What Is Market Risk?

Market risk refers to the possibility of investments losing value due to overall market changes. These changes can come from a variety of factors such as interest rates, inflation, currency fluctuations, and geopolitical events.

An example is when a global economic slowdown affects stock markets worldwide. Even strong companies can see their share prices drop because of a negative macroeconomic outlook.

In market risk analysis, the goal is to assess how sensitive investments are to such broad market movements. This is important for investment analysts and financial consultants who need to advise clients on potential exposure to events beyond a single company or sector.

Key characteristics of market risk:

- It is influenced by external factors beyond the investor’s control

- It affects nearly all assets in a market

- It can be analyzed through indicators like market volatility and interest rate trends

What Is Portfolio Risk?

Portfolio risk is the possibility that a specific combination of investments will lose value. Unlike market risk, which affects the entire market, portfolio risk focuses on the risks within the assets you actually hold.

A portfolio made up of only technology stocks, for example, will be more sensitive to changes in the tech industry. A well-diversified portfolio, on the other hand, will likely spread this risk across different sectors and geographies.

Portfolio risk assessment looks at the unique mix of assets in an investment strategy. This includes studying correlations between assets, sector exposure, and geographic exposure to determine how one investment’s performance might affect the whole portfolio.

Portfolio risk can be managed through:

- Diversification across asset classes and industries

- Allocating investments based on risk tolerance

- Regularly reviewing performance with tools like ai for data analysis or an ai report generator for quick portfolio reviews

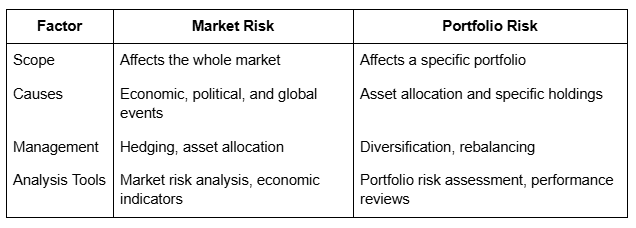

Comparing Market Risk and Portfolio Risk

Both market risk and portfolio risk are part of an investor’s reality, but they differ in scope and management.

For equity research analysts, this comparison is important when writing an equity research report. The report may outline how much of a portfolio’s performance depends on market-wide changes and how much depends on the choice of individual assets.

The Role of Investment Research in Managing Both Risks

In professional investment research, both market and portfolio risks are evaluated together. A detailed analyst report might include:

- Financial reports for companies in the portfolio

- A macroeconomic outlook to gauge market-wide trends

- Equity analysis for each holding

- Insights from equity search automation tools to identify new opportunities or threats

This data-driven approach allows financial data analysts and wealth managers to balance long-term growth with risk control.

Using Technology to Enhance Risk Analysis

Modern tools are making it easier to analyze and manage both market and portfolio risks. Equity research automation platforms can process large amounts of data quickly, saving time for portfolio managers.

An ai for equity research tool can combine ai data analysis with market indicators to create reports that highlight key risks and opportunities. Similarly, an ai report generator can produce quick portfolio snapshots for client meetings.

These technologies help ensure that risk assessment is not a one-time process but an ongoing part of portfolio management.

Practical Example

Consider an investor holding a diversified portfolio with stocks, bonds, and international assets.

- Market risk might come from a sudden global recession that causes all markets to drop.

- Portfolio risk might come from having too much exposure to a single country’s bonds, which could underperform due to political instability.

In this case, market risk analysis would look at global indicators, while portfolio risk assessment would focus on the composition of the investor’s holdings.

Why Both Matter for Long-Term Success

Managing only one type of risk is not enough. If an investor focuses only on market risk, they may overlook poor diversification within their portfolio. If they only manage portfolio risk, they might ignore global events that could impact all assets.

In equity research, both need to be addressed in the equity research report to give clients a clear view of potential threats and opportunities. For financial advisors and wealth managers, this balanced view is key to building trust and delivering strong results.

Final Thoughts

Market risk and portfolio risk are two sides of the same coin in investment research. Market risk looks at the big picture, while portfolio risk examines the specific holdings. By using advanced tools like ai for data analysis, ai report generator, equity research automation, and GenRPT Finance by Yodaplus, professionals can better measure and manage both.

For asset managers, financial consultants, and portfolio managers, combining market risk analysis with portfolio insights leads to stronger strategies and better investment outcomes. A well-prepared approach ensures that risks are understood, controlled, and aligned with client goals in today’s complex financial environment.